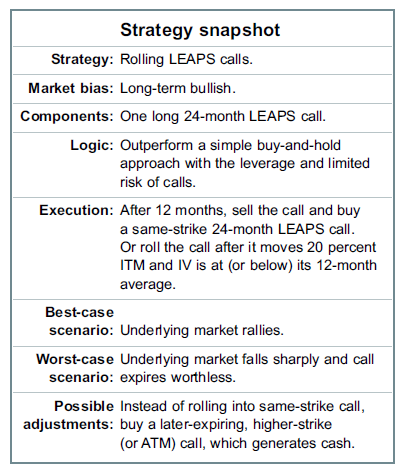

You can make money buying stocks and holding them for long periods, but you risk a large amount of capital when doing so. By contrast, buying calls can provide the same type of returns with less risk. The problem is that time decay works against you. A strategy designed to compensate for this drawback is buying long-term calls on exchange-traded funds (ETFs) that track major market indices, and selling them to buy options that expire even later — a technique called “rolling.” The strategy uses Long-term AnticiPation Securities, or LEAPS, which are options that don’t expire for at least a year. These calls behave the same as regular calls, but are designed specifically for investors with longer-term time frames. The goal is to profit from a call’s inherent leverage in a bull market. You can only lose the amount you paid for each call, which limit losses. All options expire eventually, but the rolling process allows you to stay in the trade.

Advantages of longer-term options

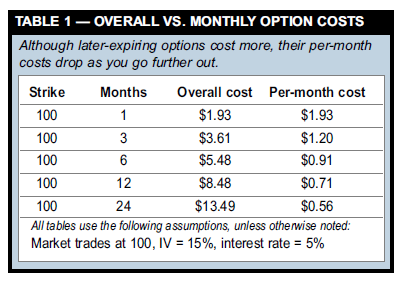

Later-expiring options cost more than their shorter-term counterparts, but the additional cost isn’t linear — i.e., a sixmonth call doesn’t cost six times as much as a same-strike call that expires next month. Instead, the cost of adding more time drops as you go further into the future. Longer-term options have lower per-month costs, on average. Table 1 compares the overall and monthly costs of at-the-money (ATM) calls with different expiration dates: one, three, six, 12, and 24 months. A one-month call costs $1.93 and a three-month call costs $3.61. But on a monthly basis, the later-expiring call costs less than the one-month call — $1.20 vs. $1.93, respectively. (For simplicity, the examples track a hypothetical underlying stock that is trading at 100; dividends are excluded.) Longer-term calls also give the underlying more time to move. Table 2 shows the cost, value at expiration, and gain or loss for various options, assuming a 10-percent annual gain in the underlying instrument. While each call moves into the money, only the longer-term calls generate profits, because only they have gained enough to offset their initial costs.

Rolling forward

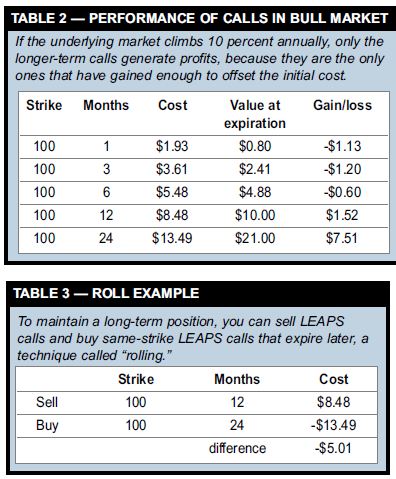

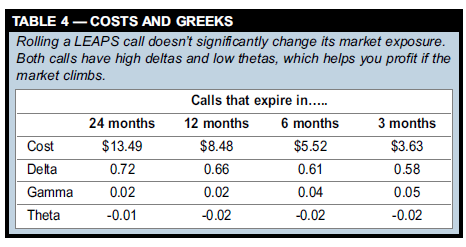

One way to maintain a position is to sell calls when they have 12 months until expiration and buy same-strike calls that don’t expire for at least two years. For example, you could sell a 12-month call for $8.48 and buy a same-strike 24-month call for $13.49 — a debit of $5.01 (Table 3). Table 4 compares the “Greeks” of the 12- and 24-month at-the-money LEAPS, and shows these options share high deltas and low thetas. This means both calls’ prices will increase by roughly the same amount if the market climbs one (1.00) point, and their prices aren’t influenced much by the passage of time.

Roll or hold?

If you wait too long to roll a LEAPS call, its delta will drop and time decay will increase, making it difficult to generate additional gains if the underlying doesn’t rally sharply. Therefore, you should roll (or simply sell) any call that expires in less than nine months and has a near-the-money strike. For the best results, hold a LEAPS call until it is at least 20 percent in-themoney and implied volatility (IV) is at or below its 12-month average. Then you can sell it, roll it forward into a same-strike call, or roll it forward and up to a higher-strike call, which generates cash. Rolling up always provides cash, but the amount is only significant at lower strike prices. For example, if you sell a call that is 10-percent in-themoney (ITM) and buy one that is five-percent ITM, you will receive much less than five percent of the underlying’s value, especially in a volatile market. But if you sell a call that is 20- percent ITM and buy one that is 10-percent ITM, you could collect roughly nine percent of the underlying’s value. You can also hold a high-delta, low-theta deepi n – t h e – m o n e y LEAPS call until expiration. Even if the underlying plummets, increased time value and volatility might help offset the losses. However, never hold at- and out-ofthe- money options until they expire. Always roll or sell these calls. Otherwise, the position’s time decay could wipe out any gains in the underlying market, and the call could have trouble increasing in value.

Rolling costs

The rolling process is fairly pre dictable, because any underlying changes in price or implied volatility will be reflected both in the call you sell and the one you buy. Therefore, the cost difference between the short and long calls is minimal. You can use the following formula as a rough guideline: Cost of roll = strike * interest rate – dividend According to this formula, rolling a 100-strike call costs $5, based on a five-percent interest rate and no dividends: 100 * 5% – 0 = $5

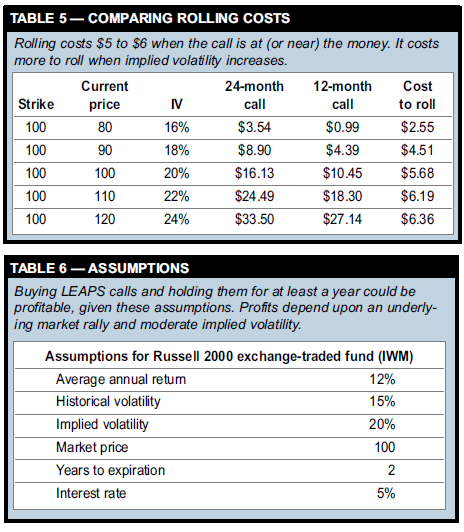

This formula isn’t perfect though. In reality, the roll’s cost could be 10 to 25 percent above or below this value. Table 5 lists the prices of 12- and 24-month 100- strike calls given both mild and extreme changes in underlying price and implied volatility. It also shows each scenario’s roll cost. For example, if the market trades at 100 with 20- percent volatility, it will cost $5.68 to roll into the next year (i.e., sell the ATM 12-month call for $10.45 and buy the same-strike, 24-month call for $16.13). Table 5 shows that rolling costs $5-$6 when the call is at (or near) the money. Rolling costs could be close to zero if the call is very deep ITM and the underlying’s dividend covers the interest cost. These costs will also be low if the call is so far OTM that any additional time premium has little value.

What are LEAPS?

Long-term AnticiPation Securities, or LEAPS, are longer-term options contracts that expire up to two years and eight months in the future. They are no different from regular puts and calls, and give the owner the right to buy or sell 100 shares of stock at any time. But instead of expiration months, they have expiration years (e.g., January 2008 LEAPS expire on Jan. 19, 2008). All LEAPS are divided into three cycles that determine when they are listed. Cycle 1 LEAPS are listed after May equity options expire, cycle 2 are listed after the June expiration period, and cycle 3 are listed after the July period, three calendar years in advance (i.e., 2010 LEAPS begin listing in 2007, 2011 LEAPS in 2008, etc.) As of Aug. 14, you can buy LEAPS on the S&P 500 index that expire on Jan. 16, 2010 — almost 30 months from now. In theory, LEAPS behave the same as regular options. In practice, however, new LEAPS have low thetas and deltas in the first few months. This means time decay is reduced, but changes in the underlying market don’t affect the option’s price as much, at least initially.

Estimating performance

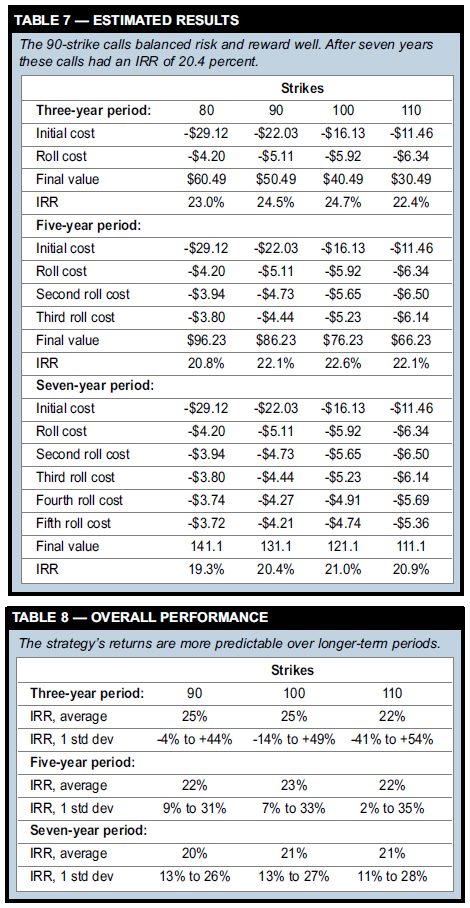

No stock index is perfect, but the Russell 2000 is a good candidate for the rolled LEAPS call strategy. Composed of 2,000 small-cap stocks, this index has gained an average 13.09 percent annually since 1993. It is more volatile than the S&P 500 and the Dow Jones Industrial Average — about as volatile as the Nasdaq Composite. The following estimates use options on the heavily traded Russell 2000 exchange-traded fund (IWM). High liquidity is not necessarily a prerequisite, because the strategy only rolls each option once a year, but narrow bid-ask spreads can help lower costs. For simplicity, we assumed the Russell 2000 ETF trades at 100, bought 24-month LEAPS at different strikes, and rolled them forward each year. Rules: 1. Buy 24-month LEAPS calls with strikes of 80, 90, 100, and 110. 2. After 12 months, sell calls and buy 24-month calls with the same strike. Table 6 lists other assumptions used here: Rolling costs are based on an estimated annual return of 12 percent; bid-ask spreads and transaction costs were not included. Table 7 shows the initial costs, rolling costs, total gains, and the internal rates of return (IRR) for all four LEAPS calls in three-, five-, and seven-year time periods. The IRR represents an estimated rate of growth, given the costs to enter the strategy and to roll LEAPS calls forward. The strategy’s costs and total gains are ultimately determined by the LEAPS call’s strike price. Lower-strike calls are more expensive at first, but rolling them costs less and they generate more profit from the underlying. The effect tends to balance out. ATM calls had the highest IRR of 24.7 percent vs. 24.5 percent (or less) for other strikes, assuming IWM rallied 12 percent each year. Higherstrike calls are more sensitive to changes in the underlying and thus include more risk. Table 7 suggests that 90-strike calls (10 percent below the market) balance risk and reward well. After seven years, these calls have an IRR of 20.4 percent, which means they double their capital every 3.5 years, on average. But if the Russell 2000 ETF climbs more than 12 percent annually, higher-strike calls would outperform them. Table 8 shows the average IRRs and standard deviations for each strike price and time period. Rolled LEAPS calls lose leverage as the market rallies. This reduces returns, but it also reduces their volatility. After seven years, the strategy’s one-standard-deviation range is very narrow (11 to 28 percent), which means performance is predictable.

A more practical approach

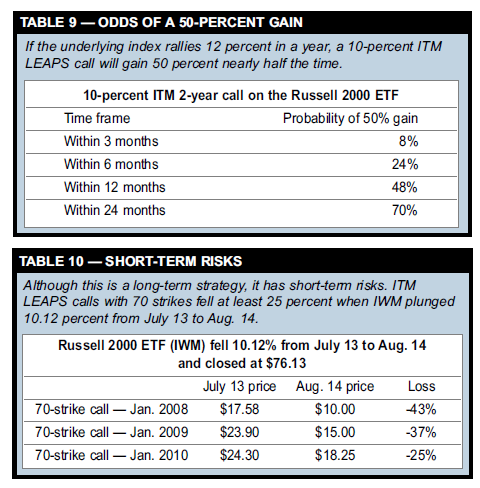

In reality, few investors buy a stock, hold it, and sell it after a predefined period. Therefore, let’s assume you will hold a LEAPS call until it gains 50 percent and then sell it. In a bull market, near-the-money LEAPS calls can rise in value quickly. Let’s start again with an index trading at 100 and use the same assumptions from Table 6. If you buy a twoyear LEAPS call with a strike of 90 for $22.03, what are the odds it will gain 50 percent? Table 9 shows the probabilities of gaining 50 percent within different time periods. If the underlying index rallies 12 percent, the LEAPS call climbs this far within 12 months 48 percent of the time. After 24 months, it gains this much 70 percent of the time. Remember, it could always expire worthless, which is why rolling is important.

Risks: Sell-offs and volatility

Historically, markets have tended to climb during longterm periods, but sharp sell-offs such as the 10-percent drop in the Russell 2000 this summer could hurt this bullish strategy. Table 10 compares the prices for three deep inthe- money LEAPS calls on the Russell 2000 before and after it fell 10.12 percent from July 13 to Aug. 14. Each LEAPS call fell at least 25 percent within a month, which highlights the strategy’s potential short-term risks. As with any option, IV changes can affect the profitability of a LEAPS call, especially when the strike is near the money. When you buy an option, you can’t lose more than you pay for it. This characteristic is a hedge, and the more volatile the underlying security is, the more expensive this hedge becomes. At first glance, the recent sell-off seems to offer a buying opportunity. But the Russell 2000 ETF’s average IV climbed from 18.1 percent — slightly below its three-year average of 19.2 percent — to 27.7 percent during this period. Buying new calls or rolling existing ones isn’t a good idea when implied volatility spikes. If IV does surge, you can always wait a week or two before placing any trades.

Related reading

“Squeezing extra profits from long calls” Futures and Options Trader, May 2007. These spreads can boost profit and lower risk if you build them from an already-profitable long call. “Selecting calls based on ROI” Options Trader October 2006. Traders seem drawn to complex options strategies, but sometimes simply buying calls is the best way to catch an up move. Learn how to weigh the possibilities by comparing various calls’ return on investment. “Carryover losses and deep in-the-money calls” Options Trader November 2006. Deep ITM covered calls help extract profits from a long-term underlying position, but you may lose the trade’s favorable tax status. Large carryover losses from prior years can fix this dilemma. “Managing profitable trades” Options Trader August 2006. Handling a profitable option trade might seem easy, but it can be difficult to decide whether to cash out or hold on for further gains. “Making the options LEAP” Options Trader December 2005. Long-Term Equity AnticiPation Securities can have expiration dates more than two years away. Find out the difference between these options and standard options and how you can use them to your advantage.

Entering spreads

Instead of buying LEAPS calls outright, you can also sell a higher-strike call that expires sooner and create a diagonal call spread. While selling a call to create a spread lowers costs, it also reduces your potential profit if the short call expires in-the-money. But this could be a good idea, especially if implied volatility surges as it did in July and August. For example, let’s assume you buy a LEAPS call that is 10-percent ITM and sell an ATM call that expires in three to six months. If IV is near its historic highs, you can collect a large premium when selling that short-term call, which helps offset the LEAPS call’s cost. But if the market rallies within six months, you may have to buy back that call at a loss. The strategy outlined here can outperform a simple buy-and-hold approach, but if the market pulls back, you could lose ground. However, the strategy’s risks and rewards are quite predictable if you hold LEAPS for long periods.